Evergrande has several other units that could be candidates for listings including its bottled water affiliate and an online home- and car-sales platform. Minsheng one of the major lenders to Evergrande made the comment on Wednesday evening in replies to investor questions on Shanghai Stock Exchanges E Interaction platform.

The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value.

Evergrande stock chinese market. Evergrandes bond and stock selloff worsened last week after Caixin Medias WeNews reported that regulators were looking into its dealings with a banking unit. Evergrande is a top-three Chinese property developer by contracted sales. Evergrande Real Estate is at the forefront of the Chinese real estate market and is known as Wan Heng Bi with the other two top three real estate companies Vanke and Country Garden.

China Evergrande Group placed 260 million shares or 266 of issued share capital of China Evergrande New Energy Vehicle Group Ltd for HK106 billion 136 billion the Chinese property. Chinese regulators have instructed major creditors of China Evergrande Group to conduct a fresh round of stress tests on their exposure to the worlds most indebted developer according to people. In March 2010 Evergrande bought all shares of Guangzhou FC.

HONG KONG Reuters - China Evergrande Group said on Tuesday its interest-bearing indebtedness has dropped to around 570 billion yuan 8823 billion from 7165 billion yuan at. Concerns about China Evergrande Groups financial health are mounting as the developer struggles to convince banks and ratings companies it can execute on an ambitious deleveraging plan. Resurgent concerns about the health of China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020.

Its also benefiting from a buoyant Chinese property market said Maggie Hu professor of real estate finance at the Chinese University of Hong Kong. The China Banking and Insurance Regulatory Commission is examining more than 100 billion yuan 156 billion of transactions between the developer and Shengjing Bank Co WeNews. The stock market disagreed with many interpreting the move as a way for the Evergrande New Energy Vehicles parent Huis indebted real estate development company to cash out.

Bonds of the worlds most indebted real estate company slumped on Tuesday after Bloomberg News reported several large Chinese banks are restricting credit to the firm. Concerns about Evergrandes financial health are mounting as the developer struggles to convince banks and ratings companies it can execute on a deleveraging plan. Resurgent concerns about the health of China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020.

Evergrandes stock jumped 9 on the news rebounding from a four-year low and delivering a hit to short sellers who had piled into bearish bets in recent weeks. For 100 million yuan. Billionaire Who Helped Evergrande Hit by Bond Stock Selloff Bloomberg News.

Chinese banks restrict Evergrande credit Funding difficulties are not the sole preserve of the hedge fund community with Evergrande Group a highly indebted property developer in China also seen. Crunch can be traced to its 2017 investment of 20 billion yuan in a unit of China Evergrande Group the worlds most indebted. The property services unit of Chinas top developer sank after blocks of shares were traded at a 12 per cent discount to Tuesdays level erasing some US19 billion of market value.

China Evergrandes top creditor has trimmed its loans to the nations most-indebted developer to assuage investors a sign lenders have started to raise their guard against default risks. We expect Evergrande to be able to roll over its bank loans but the trust loans have a higher risk of not being rolled over as they are more sensitive to market conditions and changes in the regulatory environment. Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday.

The companys shares and bonds had tumbled since the end of May after missed payments at Evergrande affiliates and a report that regulators are probing the developers ties to. June 15 2021 823 AM EDT Updated on June 15 2021 1147 PM EDT. Founder of debt-laden Chinese retailer Suning eyes stock sale.

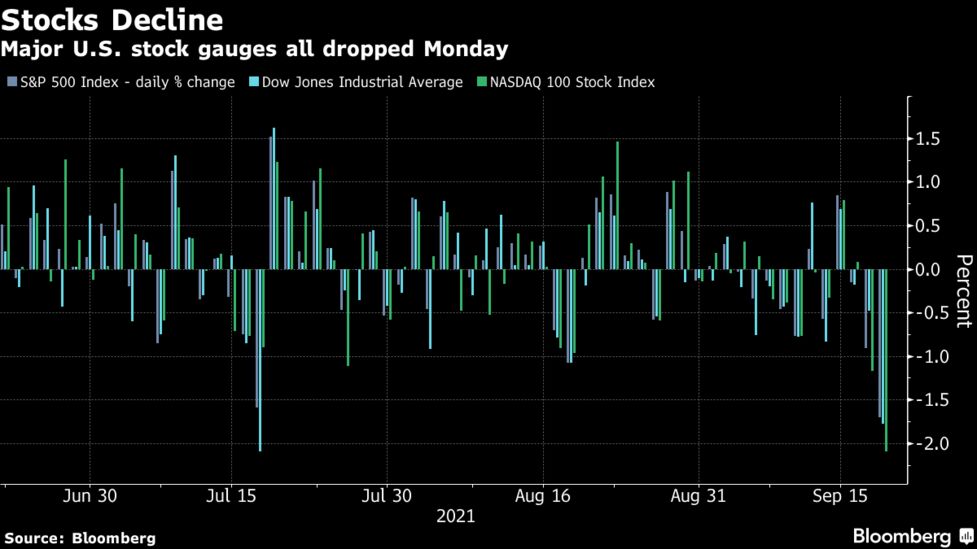

Evergrande Global Growth Worries Dampen Stocks Reuters

Premarket Stocks Fears About China S Evergrande Spread To Global Markets Cnn